|

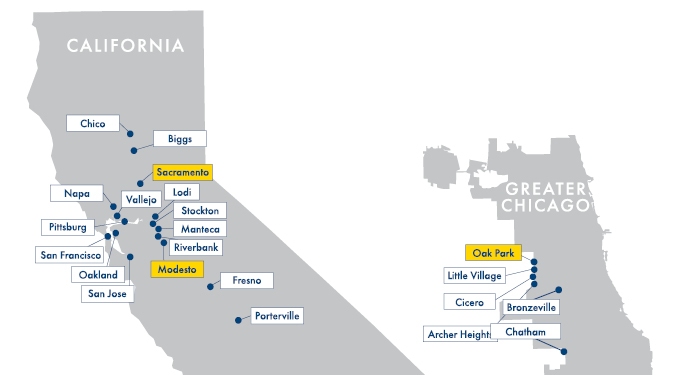

We’re thrilled to announce branch updates in our footprint. Recently, we opened a new branch in Sacramento and moved our Modesto branch to a new location on Crow’s Landing Road. In Illinois, we’re excited to welcome members from our Maywood branch to their new location in nearby Oak Park. Stop by and see us today!

|

Maximize the benefits of your refund with a high-yield term certificate. You can earn a competitive dividend in an account where your funds will remain available if needed in an emergency.

Self-Help offers a variety of high-yield term certificates that can turn your refund into future revenue for you and help create economic opportunity for low-wealth families and communities. Visit our website to learn more.

*APY=Annual Percentage Yield. Rate effective as of 4/1/23 and subject to change. Minimum $500 deposit to open an account. Federally insured by NCUA.

|

From left: the Zavaleta family and their Self-Help loan officer Adriana Clara after closing on their new home.

From left: the Zavaleta family and their Self-Help loan officer Adriana Clara after closing on their new home.

One of the best ways you can build lasting wealth, financial security and overall wellbeing for yourself and future generations is to own your home. That’s why we want to make homeownership more accessible to all. The Zavaleta family in Washington and others like them are proof-positive that homeownership is more possible than you might think.

The Zavaleta family began working with Self-Help loan officer Adriana Clara in 2021 to build their credit and savings and closed on their first home in November 2022.

To learn more about our home lending products, call us at 833-438-0304 or visit our website.

|

|

2022 Annual Report Coming Out Soon

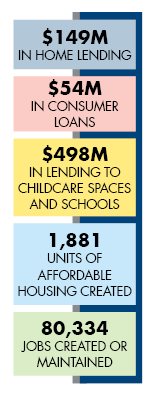

We’re looking forward to sharing the results we’ve achieved together in our 2022 Annual Report soon. Here’s just a preview of the work that your deposits have done to strengthen local economies, beautify communities, and make fair and affordable lending more accessible over our 40+ year history.

Visit self-helpfcu.org for more information and stories.

|

All deposits in Self-Help Credit Union are automatically insured by the National Credit Union Administration (NCUA) for up to $250,000. Since the creation of NCUA in 1970, credit union members have never lost a single penny of insured deposits.

Our financial strength means we always have cash on hand so that you can withdraw your money when you need it. We work hard to maintain a high net worth and high rate of liquidity so that even in periods of high demand you can rest assured that your funds will be there. Learn more.

|

Don't fall for a money-draining scam!

Scammers are always looking for ways to steal your identity or trick you into sending them money. Watch out for messages on social media, emails, and even your phone about things like cryptocurrency, miracle health products or unexpected financial transactions. Visit our website to learn how you can protect yourself.

|

Federal law requires us to tell you how we collect, share and protect your personal information. Our privacy policy has not changed. You may review our policy and practices regarding your personal information at our website. We will also mail you a free copy upon request – just call (800) 966.7353.

|